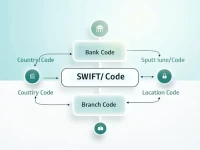

Lithuanias Bank Offers Secure SWIFT Transfers with LIABLT2XECM Code

This article discusses the SWIFT code LIABLT2XECM of LIETUVOS BANKAS (Lithuanian Bank) and its significance in international remittances. It emphasizes the necessity of using the correct SWIFT code to ensure the safety of funds and efficient transaction processing. Additionally, it provides recommendations for selecting remittance services and safeguarding transaction security.